(Bloomberg): The profits of Samsung Electronics in Korea on the 27th of October to December 2021 (the fourth quarter) were lower than the analyst forecast.The provision of special bonuses to employees and the expansion of investment in the advanced production technology of semiconductors and displays.

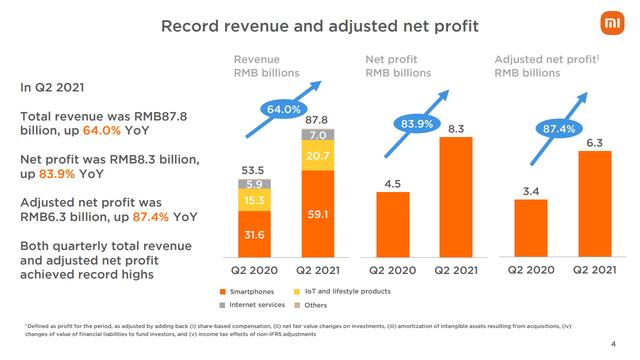

According to the presentation materials, net income increased to 10.64 billion won (approximately ¥ 1,170 billion).The average analyst for Bloomberg was 11.1 trillion won.Samsung announced this month's provisional accounts that operating income increased by more than 50 %.The company provided a special bonus to employees in late December last year.Sales were the highest ever for the fourth consecutive quarter.

Samsung has a optimistic view of the sustainable demand of the company's semiconductor through this year, and is investing in accelerating the development of the latest technology and expanding its production.In the Memory and Foundry (consignment production) category, the demand for high -priced EUVs (extreme UV) exposure devices of ASML holding is expected to increase.

ASML is "fighting every day" to secure semiconductors, and global supply shortage hits

Samsung's businesses have benefited from the growing demand, but their expenses have increased and their profitability has been impaired.For example, in the mobile business, sales increased, but marketing costs affected profits.The sales of the 2ndry business was a record high, but the cost of new facilities has been reduced in profits.

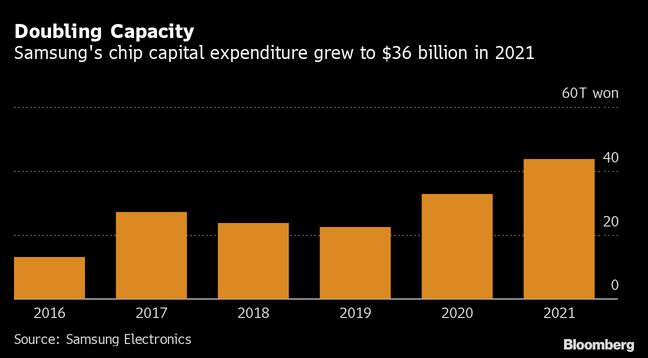

In 2021, capital investment was 48.2 trillion won, of which 43.6 trillion won was for semiconductors.Samsung's capital investment for chips is $ 36.3 billion based on the current rate.The Taiwanese Democratic Corporation manufacturing (TSMC) was $ 30 billion.

Original title: Samsung Profit Misses After More More Spending on Workers, Tech (1)

(C) 2022 Bloomberg L.P.

SOHEE KIM

最終更新:Bloomberg